Wat is vendor leasing?

Van vendor leasing is sprake als het leasecontract tot stand komt door tussenkomst van de verkoper of leverancier van het object, of enige andere partij dan de leasemaatschappij zelf (de vendor). De verkoper sluit meestal een arrangement met een leasemaatschappij, met gunstige voorwaarden voor de koper. Indien de koper geïnteresseerd is in het arrangement, brengt de verkoper de koper in contact met de leasemaatschappij. De uiteindelijke acceptatie van de koper is voorbehouden aan de leasemaatschappij.

Meerdere varianten

- Disclosed vendor leasing: de koper weet dat deze leasemaatschappij de uiteindelijke financier is van het object.

- Undisclosed vendor leasing: de koper weet niet dat een leasemaatschappij de uiteindelijke financier is. We noemen dit undisclosed vendor.

De meest voorkomende vendor lease-vorm is operational lease. Operational lease betekent dat de leasemaatschappij de investering op zich neemt en eigenaar is en blijft van het goed. Op het einde van de leasetermijn heeft de koper de mogelijkheid eigenaar te worden van het geleasde goed.

In bepaalde gevallen kan de verkoper zelf een rol spelen in de lease-structuur. Bijvoorbeeld door te voorzien in het onderhoud en reparatie van het leaseobject of door een terugkoopverbintenis aan te gaan.

Voordelen vendor leasing

Vendor leasing stelt de koper in staat gemakkelijker dure kapitaalgoederen te kopen en het stelt de verkoper in staat deze te verkopen.

- Versterking van sales en marketing propositie van verkoper

- Verkoper biedt klant een totaaloplossing

- Omzetgroei en behoud van marge;

- Verkoper loopt geen debiteuren risico meer omdat de lease financier dit heeft overgenomen;

- Meer klantenbinding door herhalingsaankopen

(als gevolg van voortijdige vervanging van geleasde bedrijfsmiddelen);Eenvoudiger en sneller investeringsbesluit voor de koper

(door verlaging van de investeringsdrempel).

Algemene cijfers leasemarkt

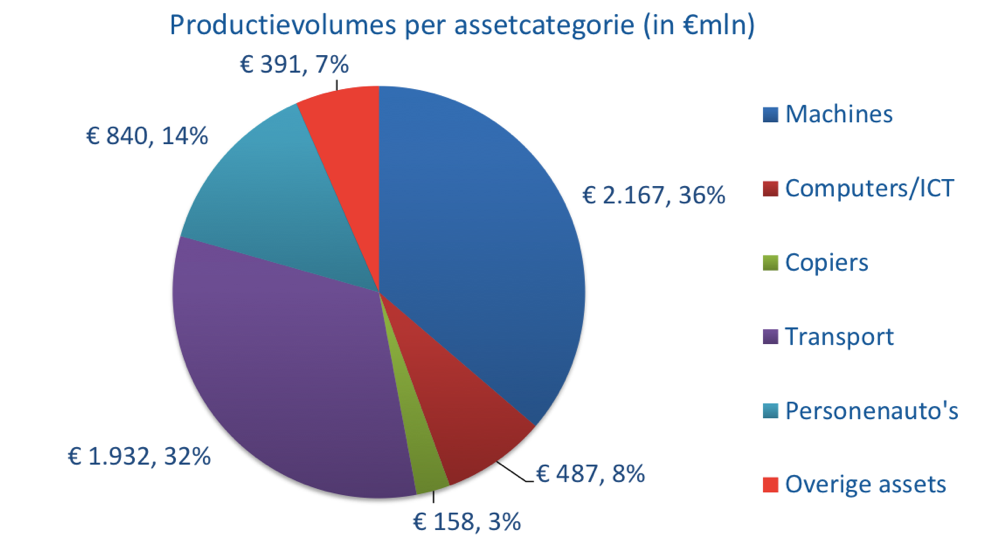

In 2017 werd voor 6 miljard euro aan nieuwe leasecontracten gesloten.

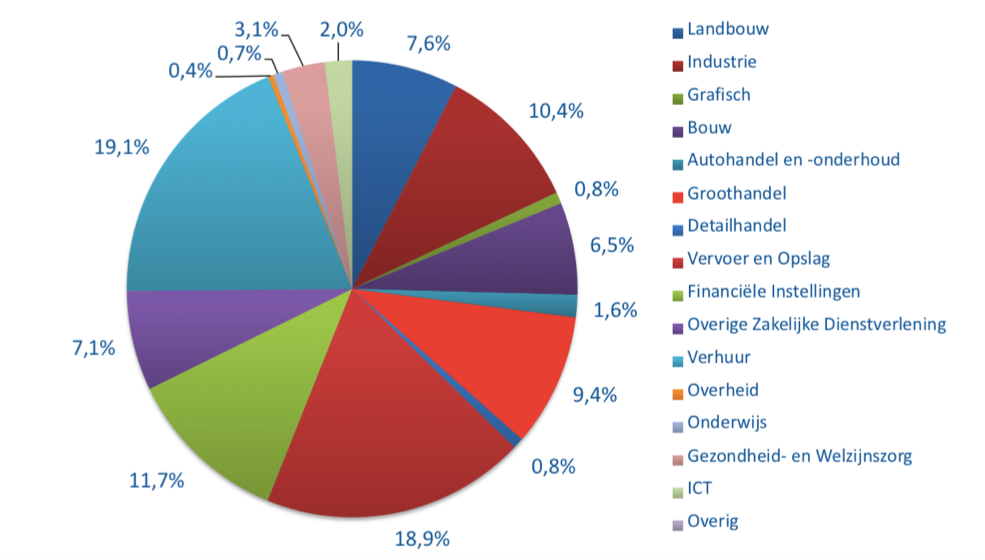

Leasing wordt in velerlei branches toegepast. De branches waarin leasing wordt gebruikt zijn:

Wilt u weten wat vendor leasing voor u kan betekenen? Neem dan contact met ons op via info@xolv.nl of 073 – 820 02 95. Onze specialisten staan u graag te woord.