A healthy cash flow is very important for any business. This is sometimes difficult, as you have no control over when your customers pay your invoices. Long-term outstanding invoices can be problematic for the continuity of an organisation. Factoring solves this problem, allowing you to do business carefree.

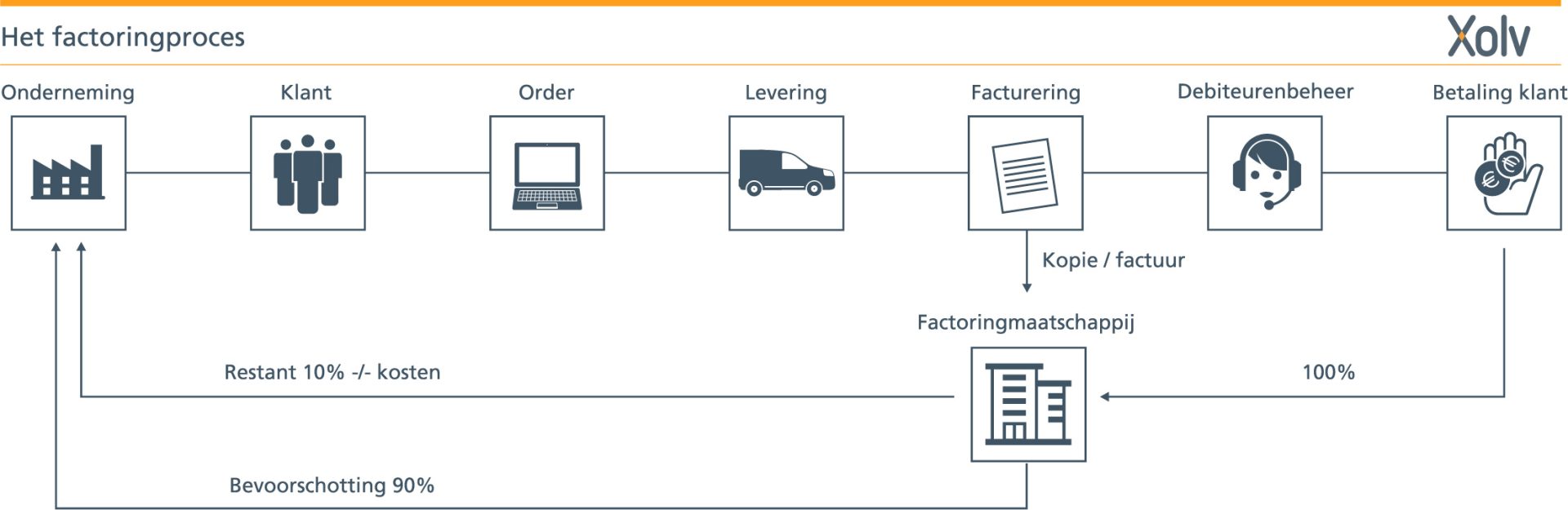

If you opt for factoring as a form of financing, the factoring company will take over your invoice and pay up to 90% of the original invoice amount. This usually happens within 24 hours of receiving the request. Because the invoice is taken over, they also assume the risk of non-payment. Once your customer has paid the full invoice, you will also receive the remaining amount in your account. In addition to invoices, factoring can also be used for purchase and inventory financing, giving companies extra room to grow. Read more about stock financing via factoring.

Faster payment: within 24 hours up to 90% of your invoice amount.

Better liquidity: no gaps in your cash flow.

Grow with you: funding automatically grows with your turnover.

Flexible: higher financing than often possible at the bank.

Additional benefit: due to the interference of the factoring company, invoices are paid faster on average.

In addition to these advantages, factoring is often an even greater benefit for SMEs. Companies get instant liquidity without depending on bank financing. Want to know more about this? Read more about factoring for SMEs.

There are also misconceptions about factoring. In this article on the 4 disadvantages of factoring you will read what is often misunderstood and how this is in practice. Want to know what forms of factoring there are? These are the 5 main forms of factoring.

Factoring costs often consist of three components:

Commission: fee for the factoring company's work.

Interest: on the amount advanced.

Credit insurance: premium that covers the risk of default.

The financing rate depends on the business turnover. With a lower turnover, financing is a bit more expensive than regular bank financing. At higher turnover, factoring rates are similar or sometimes even a bit lower. For a more comprehensive overview read this article where we the costs of factoring at a glance move.

With factoring, you do not take out a loan and therefore do not take on debt. Factoring is often seen as a form of pre-financing, but strictly speaking it is not. In fact, you sell the value of your invoices to a factoring company. By doing so, you quickly receive a large portion of the invoice amount. Depending on the chosen form of factoring, you can also outsource invoicing and collecting payments to the factoring company. Curious about the different forms of factoring? Read here about the 5 main forms of factoring.

The process to start factoring is relatively simple, but important for a flawless process.

You handle your requests exactly as you are used to. When an order comes in, you focus on delivering the product or service. Until you send the invoice, nothing changes.

When you prepare the invoice, make sure the payment details refer to the factoring company for proper payment processing. Then send the invoice to your customer and a copy to the factoring company. This is usually fully automated.

After receiving the invoice, the amount is often transferred to your account after 24 hours. This is often around 90% of the invoiced amount.

The company handles accounts receivable management and ensures a good settlement with your customer. Wondering what all this involves? Then take a look at our debtor management page for a complete overview. For higher turnovers, it is also possible to keep debtor management in your own hands.

Has the customer paid? Then the remaining amount, minus the factoring fee, will be transferred to your account. Should the company unexpectedly go bankrupt or fail to pay? No worries, the factoring company bears the credit risk, so you are assured of your money and your working capital remains protected.

Factoring is also known as accounts receivable financing and is a form of business financing whereby you sell invoices to a factoring company. You receive part of the amount immediately, while they take over the risk and often also the accounts receivable management. This means you have access to your money more quickly without taking out an additional loan.

A factoring company buys your invoices and pays out an agreed percentage within a short period of time. This is done on the basis of a factoring agreement, which includes agreements on advance payments and a possible commitment fee, the fee for making credit available. This working method is typical of the broader factoring industry, which supports entrepreneurs in improving their liquidity and cash flow.

The fees you pay consist of a commission for the factoring company's work, interest on the loan amount and, in most cases, a premium for credit insurance as well. The financing rate depends on the business turnover. With lower turnover, the financing is a bit more expensive than regular bank financing. At higher turnover, factoring rates are similar or sometimes even a bit lower.

In a factoring agreement, you transfer your invoices to a factoring company, which usually pays them within 24 hours. Here, the factoring invoice forms the basis of the transaction. The contract may include a commitment fee: a fee for making credit available. Such an agreement is part of a broader factoring arrangement, in which it is essential to fully understand the factoring company's modus operandi.

In invoice financing (or debt factoring), you sell outstanding invoices to a financier to have immediate liquidity. This is often done through a traditional form of factoring, whereby debtor management is partly taken over. With purchase financing, on the other hand, a third party actually finances your procurement costs before the invoice arises, a solution for supplier payments rather than customer invoices.

A factoring company is a financial institution that takes over your invoices, pre-finances them and often also takes care of credit management.

We have years of experience in financing and protecting working capital. We will help you find the right partners that fit your situation perfectly. We are 100% independent and have contacts with almost all leading parties in the market. This is how we find the best possible factoring deal to suit your situation. Together with you, we write a concise financing application to increase the chances of acceptance. In short: for tailor-made financing and maximising your working capital funding, you have come to the right place! Want to know more?

Want to know more?

Direct quotation request?

Directly transfer intermediation?

Concise product summary (PDF)?