Voor elk bedrijf is een gezonde cashflow van groot belang. Dit is soms lastig, u heeft immers geen controle over wanneer uw opdrachtgevers hun rekeningen betalen. Langdurig openstaande rekeningen kunnen problematisch zijn voor de continuïteit van een organisatie. Factoring verhelpt dit probleem, zodat u zorgeloos kunt ondernemen. Factoring is een vorm van debiteurenfinanciering en kan voor grotere bedrijven worden aangevuld met inkoop- en voorraadfinanciering.

Kiest u voor deze vorm van financieren, dan laat u de factormaatschappij uw factuur direct uitbetalen. De maatschappij neemt uw factuur over en keert tot maximaal 90% van het originele factuurbedrag uit. Dit gebeurt meestal binnen 24 uur nadat de aanvraag ontvangen is. Omdat de factuur overgenomen wordt, nemen zij ook het risico van wanbetaling over. Heeft uw klant de volledige factuur betaald, dan ontvangt u ook het resterende bedrag op uw rekening.

De kosten die u afdraagt bestaan uit een provisie voor de werkzaamheden van de factormaatschappij, de rente over het geleende bedrag en in de meeste gevallen ook een premie voor de kredietverzekering. Het financieringstarief is afhankelijk van de bedrijfsomzet. Bij een lagere omzet is de financiering wat duurder dan een reguliere bankfinanciering. Bij een hogere omzet zijn de factoring-tarieven vergelijkbaar of soms zelfs wat lager.

Wat zijn de voordelen van een factoring financiering en voor wie is het bedoeld? Een belangrijk voordeel is dat de ondernemer niet hoeft te wachten op zijn geld totdat de opdrachtgever betaald heeft. Hiermee verbetert de liquiditeitspositie van het bedrijf. Daarnaast groeit de financiering automatisch mee met de groei van de onderneming en verstrekt een factormaatschappij hogere financieringen dan een reguliere bankfinanciering. Een vaak vergeten voordeel is dat de gemiddelde betaaltermijn van de facturen korter wordt door de bemoeienis van de factormaatschappij.

Er zijn een aantal foute opvattingen, zaken die vaak gezien worden als de 4 nadelen van factoring, lees ons artikel over dit onderwerp om een beter beeld te krijgen over factoring.

Het proces om factoring op te starten is relatief eenvoudig, maar belangrijk voor een feilloos proces.

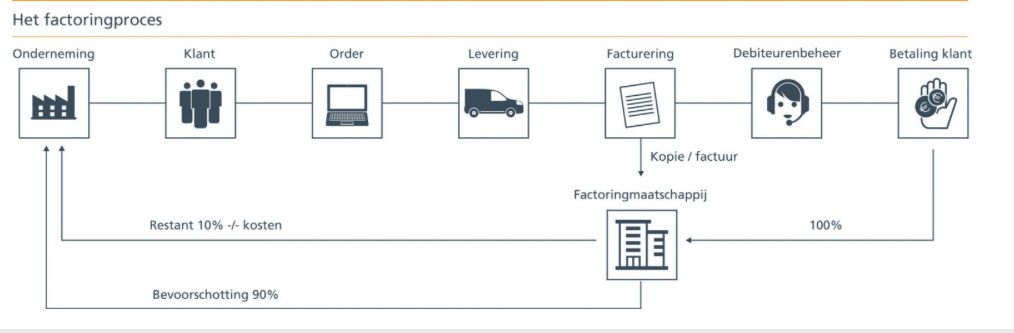

U handelt uw aanvragen precies af zoals u gewend bent. Wanneer een order binnenkomt, focust u zich op het leveren van het product of dienst. Tot het moment dat u de factuur verstuurt, verandert er niets.

Wanneer u de factuur opstelt, zorg er dan voor dat de betalingsgegevens verwijzen naar de factormaatschappij voor een correct verloop van de betaling. Daarna stuurt u de factuur naar uw klant en een kopie naar de factoringmaatschappij. Dit gaat veelal volledig geautomatiseerd.

Na het ontvangen van de factuur wordt het bedrag vaak na 24 uur al overgemaakt op uw rekening. Dit is vaak zo’n 90% van het gefactureerde bedrag.

De maatschappij handelt het debiteurenbeheer af en zorgt voor een goede afwikkeling met uw klant. Benieuwd wat hier allemaal bij komt kijken? Bekijk dan onze debiteurenbeheer pagina voor een compleet overzicht. Bij hogere omzetten is het ook mogelijk om het debiteurenbeheer in eigen hand te houden.

Heeft de klant betaald? Dan wordt het resterende bedrag, minus de factoringkosten, overgemaakt op uw rekening. Mocht het bedrijf onverhoopt failliet gaan of niet betalen? Geen zorgen, de factoringmaatschappij draagt het kredietrisico, zo bent u verzekerd van uw geld en blijft uw werkkapitaal beschermd.

Wij hebben al jarenlang ervaring met financieringen en het beschermen van werkkapitaal. Wij helpen u met het vinden van de juiste partners die perfect aansluiten bij uw situatie. Wij zijn 100% onafhankelijk en hebben contacten met vrijwel alle vooraanstaande partijen in de markt. Dit is hoe wij de best mogelijke factoringovereenkomst vinden die past bij uw situatie. Wij schrijven samen met u een beknopte financieringsaanvraag om de kans van acceptatie te vergroten. Kortom: voor een financiering op maat en maximalisatie van uw werkkapitaalfinanciering bent u bij ons aan het juiste adres! Meer weten?

Meer weten?

Direct offerte aanvragen?

Direct overdragen intermediairschap?

Beknopte samenvatting product (PDF)?