This year is likely to be another good year for the staffing industry, but weaker times are coming. It is important to anticipate this now. The financing and credit risk scan developed by Xolv especially for the temporary employment industry helps.

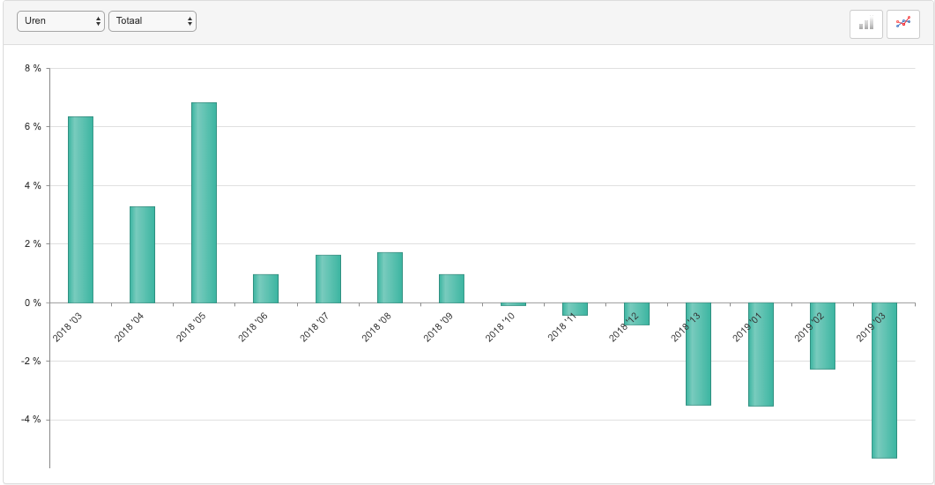

Development of the number of hours worked in the Netherlands

Growth in the global and Dutch economies is slowing down. A logical consequence is that the number of temp hours will also decline again in the coming years. The trend in the number of hours in weeks 9-12 this year is as follows:

Source: ABU

ABU reports that in this period the number of hours fell by 5% compared to the same period last year. As this period counted the same number of workable days as the same period last year, no correction has been applied.

Challenges in the staffing industry

Even during the economic upturn of recent years, the staffing industry faced challenges and developments that are still valid today:

- Shortage of available labour;

- Margins are under more pressure;

- Smaller staffing agencies are on average doing better than larger staffing agencies;

- Consolidation in the staffing industry continues;

- Companies are increasingly hiring flex workers;

- Temporary employment agencies continue to expand their range of services.

Financing and credit risk scan for the temporary employment industry

Given the economic outlook, it is important for the temporary staffing industry to anticipate more difficult times now. Ensure tight credit management, insure against credit losses and arrange good financing in order to have sufficient working capital. Especially for the temporary employment industry, Xolv has developed a financing and debtor risk scan in which we provide a quick insight into debtor risks and financing possibilities. As a result, it quickly becomes clear where a possible need lies and what steps should be taken.

Are you interested in the financing and credit risk scan developed especially for the temporary employment industry? Then contact us at info@xolv.nl or 073 - 820 02 95. Our specialists will be happy to assist you.